If you need to withdraw more than this amount, send a letter to the management of RCB Bank requesting an overdraft.

#Rcbc chequebook balance free#

You are free to take out any amount you want from your RCBC Savings Account so long as the aggregate for the day does not go over P500,000 (P1 million per month). Transfers that are made to locations that are not part of the bank’s network, on the other hand, are subject to a fee. When moving money from one RCBC Bank account to another, you won’t be charged any fees as a result of the transaction. This is provided that you meet the requirements that the bank has set forth.

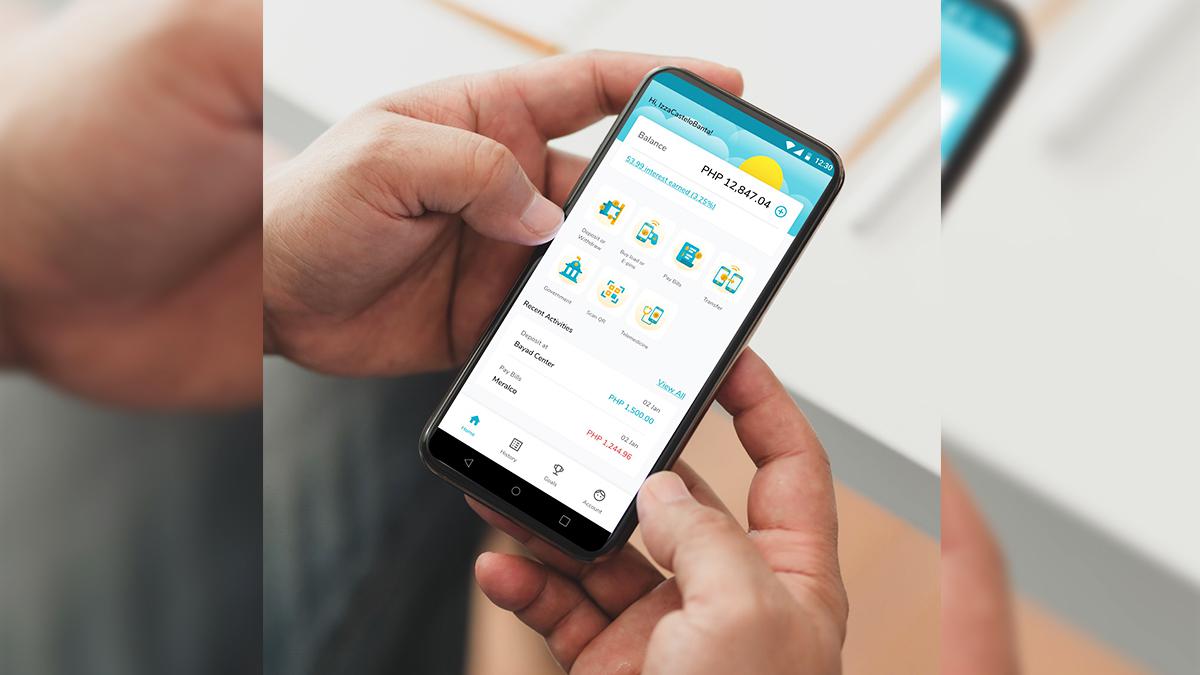

If you make a withdrawal from your RCBC Savings Account using the bank’s internet banking services or automated teller machines, you will not be assessed a fee for the service provided by the bank. No service charge for withdrawals and transfers You become eligible for additional privileges if you consistently keep a balance of P50,000 or more in your account. The bigger the deposits you make into your account, the more interest you will accumulate on those deposits. The RCBC Savings Account offers a competitive interest rate of three percent (3%) on all deposits, provided that the funds are kept in the account for a period of at least one year. RCBC provides a variety of deposit products to meet your requirements, including the following: In the event that you experience an issue with your account or have a question regarding one of their services, RCBC will get back to you as soon as possible with answers that are catered specifically to YOU! What are the various RCBC Deposit Products (Savings)? Last but not least, they offer superior levels of customer service across the board. You have access to all of your accounts at any time of day and from any location, regardless of the device you use or where you are! You can even pay your bills with just a few clicks of the mouse if you do it online. The fact that RCBC’s online banking website is simple to navigate is yet another advantage of banking with the institution. You can improve your financial situation while at the same time contributing to the growth of the Philippine economy by maintaining your funds within the country. For instance, they provide RCBC Savings Deposit Products to their customers. This corporation takes great pride in its heritage and harbours the ambition of making a positive contribution to the national economy. They are a bank that is owned and operated by Filipinos first and foremost. So, what is it exactly that makes RCBC so special? You have access to a wide variety of financial institutions, and it is up to you to select the one that is most suitable to meet your needs. They are an excellent choice because they have confidence in their financial institution and receive support from it as a result of their knowledgeable and helpful staff. RCBC has been working in the banking industry for more than a century, and the company is committed to offering its clientele the highest possible level of expertise and knowledge. If you are interested in personally applying for a savings account with RCBC, here’s how: Opening an RCBC OFW Savings Account With RCBC’s extensive selection of banking products and quality delivery of services, a lot of people with various backgrounds have entrusted their finances with RCBC. The RCBC Savings Bank is a member of the Yuchengco Group of Companies (YGC), an organization composed of major players in all three aspects of Integrated Financial Services (banking, insurance, and investment). It is also one of the most successful thrift and commercial banks in the country today. The Rizal Commercial Banking Corporation (RCBC) is considered as one of the leading universal banks in terms of assets and client reach in the Philippines.

#Rcbc chequebook balance how to#

Reading the rest of this guide will provide you with additional information regarding how to open an RCBC OFW savings account online.īy Judgefloro – Own work, CC BY-SA 4.0 Applying for an RCBC Savings Account Customers of RCBC are eligible for a number of additional features and advantages, including a high interest rate, the elimination of monthly maintenance fees, and the provision of a free ATM card. After you have established an account, you will be able to access it either online or through a mobile application. RCBC requires only a few pieces of identification in order for you to open a savings account with them. Why not get started right away by opening a savings account with RCBC?

If you ever find yourself in a financial bind, you can get money quickly and conveniently from an RCBC ATM. In addition to this, the money that you deposit will earn interest, which will assist in the growth of your savings over time. To get started, you can use RCBC’s online banking system to handle all your account management needs and make money transfers.

It is easy and convenient to open an RCBC OFW savings account online, and doing so has a number of benefits.

0 kommentar(er)

0 kommentar(er)